18 Oct Richmond ‘on the Right Path’ but With a Long Way to Go in Latest Financial Analysis

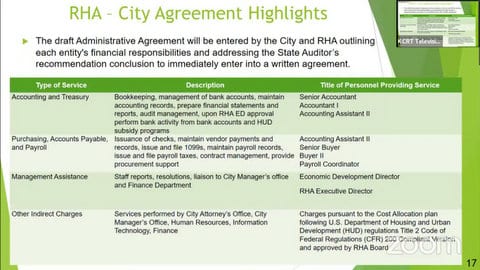

(Screenshot captured by Samantha Kennedy / The CC Pulse)

By Samantha Kennedy

The Richmond City Council received a presentation at its Tuesday meeting showing how steps taken toward funding post-employment benefits for city workers will impact the city’s financial situation.

The council previously passed funding policies for other post-employment benefits, known as OPEB, cash reserve and pension at its June 27 meeting. The policies are a part of the corrective action plan implemented by Richmond in accordance with recommendations from the state auditor’s audit of the city published in 2022. The recommendations seek to remedy “poorly funded retirement benefits” as a result of missed funding opportunities and increasing expenses.

Under the current funding policy adopted by the council, OPEB, which includes health benefits for city employees who retired directly from the city, contributions to the fund will increase for about 20 years. Contributions will drop significantly at this time because the city’s unfunded liability will be paid.

“You’re on the right path,” GovInvest consultant Ira Summer said. “But you’re at the beginning of this marathon.”

Summer said the proposed 10% year-end budget surplus contribution toward OPEB in the policy will cost more money at the beginning but will save the city money overall. Assuming a surplus of $1 million each year, he said, required contributions would begin to decrease in about 10 years.

The policy also has the potential to improve the city’s bond rating, which can give the city better interest rates on things like bonds and decrease costs.

Council member Melvin Willis expressed concern with future councils deciding to do away with the 10% year-end surplus contribution. Willis said the council changes every year alongside the economy and asked how often receiving updates is necessary and how often they will actually get them.

Summer said frequent updates are not necessary. The city already updates the council on unfunded liabilities in OPEB during annual financial reviews and keeps a close eye on it throughout the year. However, Summer told the council that the update and projections are based on expected events and certain scenarios, such as the loss of the 10% contribution or significant change in the economy, aren’t part of projections. But city staff can work with consultants to prepare for such events.

Contributions go into a trust and incur interest so the city doesn’t have to always make a contribution to OPEB. If the city has a tough year financially, money from the trust can be used to pay for benefits that year.

Council member Doria Robinson asked why the 20-year pay period the city has would not decrease once the additional 10% annual contribution was added.

Because the money gets put in a trust, Summer said, the debt is not being paid directly. He said the city’s policy could be changed to decrease the amount of time it has to pay these benefits.

Paying off this debt in a shorter amount of time would allow more flexibility in future city budgets, a better credit score and less interest incurred.

“You would save a lot of money,” Summer said.

The next Richmond City Council meeting is on Oct. 24.

No Comments